DEFECTIVE MERCHANDISE HANDLING

When a

customer receives “defective” merchandise a credit to the customer’s account is

necessary and a subsequent billing to the appropriate responsible party should

follow. In almost all cases the

responsible party is either, the merchandise vendor, the carrier, or you. The example to follow explains in detail,

crediting the customer and the follow-up billing of the responsible part.

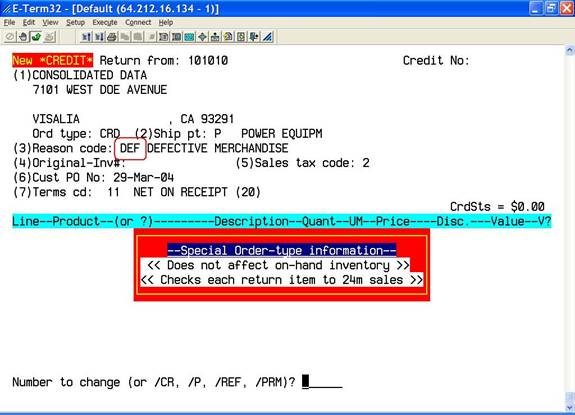

DEFECTIVE MERCHANDISE CREDIT

Select Credit

Entry (option # 5 from the Order Entry Functions menu).

Type

(customer number) <enter>.

At

the number to change prompt, type 3

<Enter>. Type DEF <Enter>. This will

not affect inventory and will check back 24 months to verify the sale of the

items being credited.

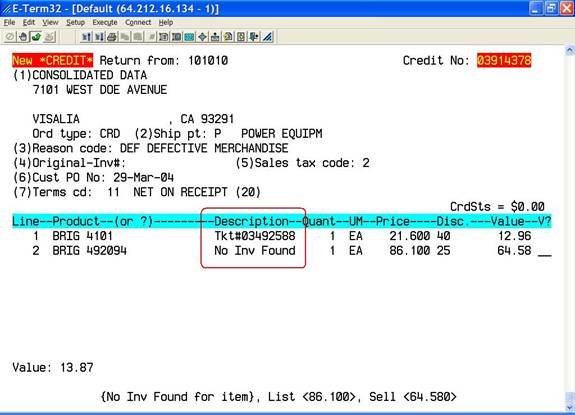

At

the part number prompt, type (part

number) <enter> type (quantity)<enter> that was defective. If the part number has been flagged as “non-returnable”

then you will have to enter the part number followed by a “/O” then enter the

override password.

Since

the program searches the previous 24 months for the sale of the item being

credited the most recent sales ticket will be displayed in the description

field and the sales price and discount will be displayed in the appropriate

fields as well. The cursor will advance

to the next line for entry of another item.

If no previous purchase is found, a message stating “No Inv Found” will

be displayed and the cursor will stop at the “V?” prompt. You can either accept the item by pressing

<enter> or reject the item by typing “C” <enter> thereby canceling

the line.

You

can enter a text message explaining the nature of the defect if necessary.

Finish

the credit.

The

defective merchandise credit issues a credit to the customer for the defective

items but does not put the merchandise back in stock. In almost all cases the defective merchandise

should be charged to the vendor, the carrier, or an in-house expense account.

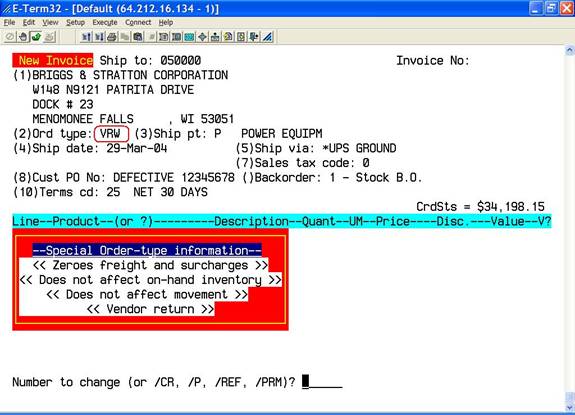

DEFECTIVE MERCHANDISE BILLING TO THE VENDOR

Select Invoice

Entry (option # 4 from the Order Entry Functions menu).

Type

(customer number) <enter>. This should be the vendor’s charge back

account number, (V something).

Type “2” <enter> and change

the order type to “VRW” and press <enter>.

Type “8”

<enter> and change the customer P.O. field to the defective claim number

you want to reference and press <enter>.

Enter the part numbers and

quantities of the items being claimed.

Finish the invoice.

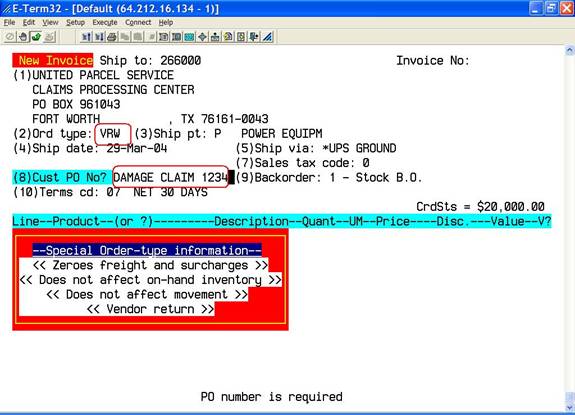

DEFECTIVE MERCHANDISE BILLING TO THE CARRIER

Select Invoice

Entry (option # 4 from the Order Entry Functions menu).

Type

(customer number)

<enter>. This should be the

carrier’s charge back account number, (V something).

Type “2” <enter> and change

the order type to “VRW” and press <enter>.

Type “8”

<enter> and change the customer P.O. field to the damage claim number you

want to reference and press <enter>.

Enter the part numbers and

quantities of the items being claimed.

Finish the invoice.

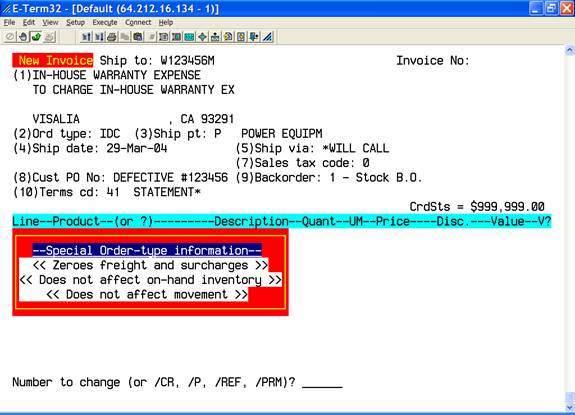

DEFECTIVE MERCHANDISE BILLING TO THE IN-HOUSE EXPENSE

ACCOUNT

Select Invoice

Entry (option # 4 from the Order Entry Functions menu).

Type

(customer number)

<enter>. This should be the

in-house expense account number, (W something).

Type “2” <enter> and change

the order type to “IDC” and press <enter>.

Type “8”

<enter> and change the customer P.O. field to the defective claim number

you want to reference and press <enter>.

Enter the part numbers and

quantities of the items being claimed.

Finish the invoice.

The entire amount of the

billing will be cleared to an internal expense account for accounting purposes.